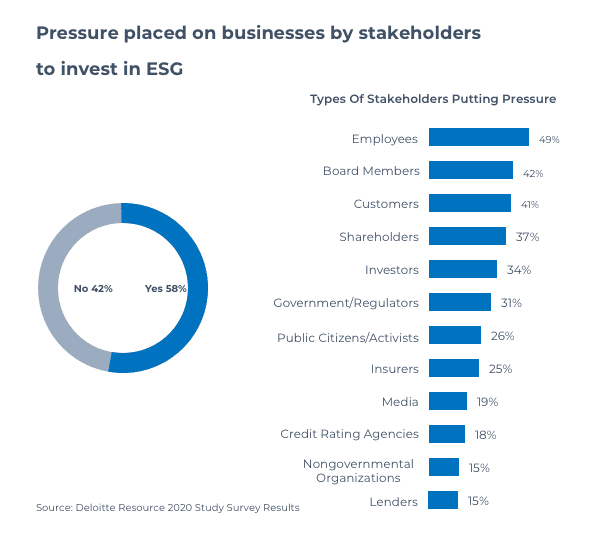

When it comes to addressing economic, health, safety, and environmental inequalities, current data suggests there’s both good and bad news. The good news is that ESG investing has grown by 42% (almost five trillion USD) in just two years. This means businesses have more incentive than ever to improve their environmental, social, and governance (ESG) performance. The bad news is that the COVID-19 pandemic has undone decades’ worth of progress towards the Sustainable Development Goals (SDGs). The resulting surge in environmental and social problems from the pandemic means that for governments, huge businesses, and their supply chains, the pressure to deliver on ESG principles is on. Keeping up with ESG standards will be more challenging in the next few years, but ESG investments will also continue to grow. Knowing the current ESG trends will help companies keep up with investor demands and stay afloat. The following sections will cover the top 3 ESG investing trends.

Slowing Down Climate Change

Despite efforts to create a pathway to net-zero emissions by 2050, countries have fallen short of their emissions targets. According to the 6th IPCC Assessment Report, if it continues increasing at its current rate, the global temperature is set to climb past 1.5° C in the next decade. This finding emphasizes the need for bold commitments and drastic measures to limit global warming and, by extension, climate change. The corresponding stronger storms, prolonged droughts, and rising sea levels are beyond environmental concerns. From the business perspective, the threat of more devastating climate change impacts means stakeholders will be looking to invest in less carbon-intensive business solutions. To achieve Net Zero by 2050, the International Energy Agency estimates that the collective nations of the world will need to invest at least five trillion USD annually into clean energy for at least twenty years. This also assumes a lack of additional investments in new fossil fuel supply projects and existing coal-fired power plants that do not use any carbon capture or conversion technology. In a bid to drastically change the current version of “business as usual,” the Glasgow Financial Alliance for Net Zero (GFANZ) is also committing 130 trillion USD in financing for green investments. A total of 450 financial firms spread out across 45 countries make up GFANZ. The coalition’s initiatives are likely to fuel a surge in green investments for many years to come.

Social Responsibility

The COVID-19 pandemic has exacerbated pre-existing economic, racial, and gender inequalities. The International Monetary Fund reports that the pandemic threw roughly 120 million people worldwide into extreme poverty. Between January 2020 and April 2021, at least 5000 violent demonstrations took place as a result of these pandemic-induced economic blows. In response, the UN Development Programme has alerted governments to the eroding social cohesion amidst this worldwide crisis. In the United States, even the pandemic has not stopped huge protests and mass gatherings forwarding a multitude of causes. As such, investors are now becoming even more focused on looking through the social lens to assess a company’s performance. Where a company stands on social issues and how it treats its employees and host community can significantly influence investor perceptions.

Data Transparency

Models typically predict future outcomes based on previous conditions. However, the pandemic has brought on unprecedented challenges, making it extremely difficult to hypothesize on the future of financial performance. Complicating this predicament is the deluge of climate reports coming out month after month. The Net Zero emissions by 2050 target is rapidly slipping away and the world has a rather narrow window to curb CO2 emissions to keep devastation to the climate at bay. More than ever, investors demand standardized, unambiguous emissions data rather than mere statements describing current and future ESG-directed efforts. Hence, businesses must keep up with more stringent data reporting standards to be able to attract and keep investors.

The pandemic is sweeping through decades’ worth of efforts to achieve the SDGs. While this has made keeping up with ESG standards much harder, the investing trends remain the same:

- Slowing down climate change

- Social responsibility

- Data transparency

Two significant changes, however, are worth noting. The first is the dire urgency for huge enterprises to abide by ESG standards to stay on course with SDG and Net Zero timelines. The narrow window for the Net Zero target, combined with brewing social unrest after a pandemic-induced economic setback, has manifested a need for quicker, more impactful actions. The second is that data transparency has become more important than ever. Investors require reliable data to assess how much a company makes itself accountable for environmental and social damage. As they base their decisions on this information, not releasing ESG disclosures implies that a business does not have any data collected to be released, and therefore, is not sustainable enough to commit to.

Author Bio

The SafetyStratus Research Advisory Group (RAG) brings together thought leaders from the global environmental, health, and safety community to promote best practices and provide key insights in the profession and the industries they serve. The Research Advisory Group also advocates, where practical, the intersection of and advances with the use of technology, such as the SafetyStratus enterprise EHS software platform. Group membership consists of representatives from across varied disciplines and market sectors as well as select members of the SafetyStratus team.

The primary objectives of the SafetyStratus RAG partnership are to:

- Build a strategic partnership between EHS practitioners and the SafetyStratus team.

- Provide engaging and practical content to the global EHS community.

- Provide discipline and market feedback specific to SafetyStratus products and services.

While the objectives of the RAG are varied, the primary public-facing outcome will be available through engaging and practical content found on the SafetyStratus resource pages. Various articles, papers, and other valuable resources will be produced and shared as part of an ongoing effort to cultivate a robust community. Ultimately, the SafetyStratus RAG will expand to have a broader reach and provide opportunities for more inclusion by all interested EHS professionals in a collaborative community environment.

Bibliography

Abnett, K. (2021). Countries’ emissions pledges still fall short of global climate goals, UN says. Reuters. Retrieved 9 November 2021, from https://www.reuters.com/business/environment/countries-emissions-pledges-still-fall-short-global-climate-goals-un-says-2021-09-17/.

Alderman, L., & Nelson, E. (2021). Global finance industry says it has $130 trillion to invest in efforts to tackle climate change.. Nytimes.com. Retrieved 9 November 2021, from https://www.nytimes.com/2021/11/03/world/europe/cop26-climate-change-finance-industry.html.

Brown, A. (2021). COVID-19 eroding social cohesion and triggering rise in civil unrest in crisis-affected countries, alert UNDP, g7+ | United Nations Development Programme. UNDP. Retrieved 9 November 2021, from https://www.undp.org/press-releases/covid-19-eroding-social-cohesion-and-triggering-rise-civil-unrest-crisis-affected.

Eltobgy, M., Brown, T., & Picard, N. (2021). Here’s why comparable ESG reporting is crucial for investors. World Economic Forum. Retrieved 9 November 2021, from https://www.weforum.org/agenda/2021/07/comparable-esg-investors/.

Ferreira, F. (2021). Inequality in the Time of COVID-19. IMF. Retrieved 9 November 2021, from https://www.imf.org/external/pubs/ft/fandd/2021/06/inequality-and-covid-19-ferreira.htm.

Pathway to critical and formidable goal of net-zero emissions by 2050 is narrow but brings huge benefits, according to IEA special report – News – IEA. IEA. (2021). Retrieved 9 November 2021, from https://www.iea.org/news/pathway-to-critical-and-formidable-goal-of-net-zero-emissions-by-2050-is-narrow-but-brings-huge-benefits.

Schreier, H. (2021). After The Pandemic: ESG Investing Trends For 2021 And Beyond. Forbes. Retrieved 9 November 2021, from https://www.forbes.com/sites/halseyschreier/2021/05/12/after-the-pandemic-esg-investing-trends-for-2021-and-beyond/?sh=318327d67b74.

Strohecker, K. (2021). Analysis: Pandemics & protests: Unrest grips developing countries. Reuters. Retrieved 9 November 2021, from https://www.reuters.com/world/pandemics-protests-unrest-grips-developing-countries-2021-07-28/.

The Intergovernmental Panel on Climate Change. (2021). Global Warming of 1.5°C. IPCC.

UN report finds COVID-19 is reversing decades of progress on poverty, healthcare and education | UN DESA | United Nations Department of Economic and Social Affairs. Un.org. (2021). Retrieved 9 November 2021, from https://www.un.org/development/desa/en/news/sustainable/sustainable-development-goals-report-2020.html.