Whitepaper: Environmental Social & Governance

The COVID-19 pandemic is an event that no one could have foreseen, and the collateral

damage has been felt worldwide. Widespread illness and fatalities lead to

socioeconomic disruption, halting supply chains and global trade, pushing millions

into poverty, and changing the way businesses operate “normally.” Now that we’ve

entered 2022, it has become clear that businesses cannot continue or return to

operations as they were before the pandemic. To become more resilient and robust,

organizations need to adopt business practices that positively affect society and the

environment, with a particular focus on social responsibility and gaining the social

license to operate from the communities and environments they contribute to and

depend on.

Continue Reading

Fill out the form to continue reading

ESG

Environmental Social & Governance

What is ESG?

The COVID-19 pandemic is an event that no one could have foreseen, and the collateral damage has been felt worldwide. Widespread illness and fatalities lead to socioeconomic disruption, halting supply chains and global trade, pushing millions into poverty, and changing the way businesses operate “normally.” Now that we’ve entered 2022, it has become clear that businesses cannot continue or return to operations as they were before the pandemic. To become more resilient and robust, organizations need to adopt business practices that positively affect society and the environment, with a particular focus on social responsibility and gaining the social license to operate from the communities and environments they contribute to and depend on.

Conscious and responsible stakeholders’ enthusiasm for investing in societies for a post-pandemic recovery is an additional incentive for businesses to contribute to the social and environmental good. Investors can reference a company’s ESG performance as a guide when making assessments. The COVID-19 pandemic has been a turning point for the ESG industry and has emphasized the value of environmental, social, and corporate governance issues in capital markets. Any progress towards achieving the Global Goals, also known as the UN Sustainable Development Goals, directly correlates with the overall ESG performance of businesses and the strength of partnerships with key stakeholders (community-based organizations, governments, non-profits, etc.)

What and Why?

ESG is the umbrella term for the components of sustainable and responsible finance. It is a framework for monitoring environmental, social, and governance factors, propagating financial data to investment decision-making processes. Companies that understand their corporate responsibility take into consideration ESG issues relevant to their business operations and services. Such companies embed ESG values into business strategies for the benefits of increased financial top-line growth, employee productivity, reduced bottom-line cost, volatility, and regulatory and legal interventions (fines, sanctions.) Comparatively, companies with poor ESG performance are associated with a higher cost of capital and level of volatility owing to operational controversies (labor strikes, fraud, noncompliance, and other governance irregularities.)

As public awareness over the societal and environmental impacts of business reaches an all-time high, reporting on ESG performance is fast becoming compulsory. Keeping ahead of regulations and remaining competitive in this economy means companies must take advantage of the benefits of ESG by embedding it into their business core. Businesses that do not measure and manage their ESG impact will fail to comply with new guidelines, creating issues with future regulatory, legal, and/or operational requirements. When businesses incorporate ESG principles within their core (sooner rather than later) they will inevitably generate more success, becoming more diversified and equal and showing more concern for the health and welfare of their employees and all other stakeholders. The positive impact on the communities and

environment they depend on (and subsequently, the business itself) is incalculable.

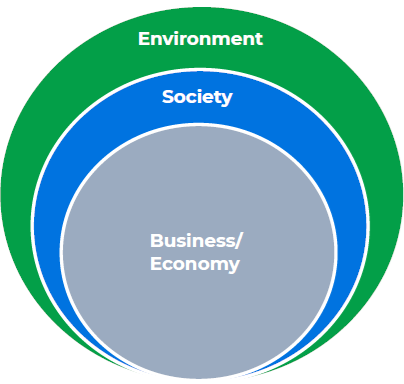

As shown in the diagram, businesses/economies nest within the realm of society, while society itself is a part of the greater environment. This shows that whatever negatively (or positively) impacts the environment, and the society it depends on, will have a similar impact on the businesses that exist within them.

“E” is for Environmental

The “E” in ESG is the assessment of how a company interacts with the natural or physical environment. It is one of the three key factors in understanding ESG risks and opportunities, detailing a company’s utilization of natural resources and the effect of its operation on the environment, both in direct operations and across supply chains. As businesses directly depend on natural resources to operate, ensuring that their operations and activities are carried out ethically and responsibly is critical. Companies that ignore the effect of their policies and operations on the environment are more likely to face financial risk.

Historically, businesses have not always had controls placed on the use of natural resources. However, with the steady rise in the global population, there is a significant increase in pressure on natural resources. Businesses (as well as individuals) must consider their responsibility to the environment and the future generations that depend on it.

The first step towards this responsibility is understanding how business operations impact relevant environmental issues. The following are environmental factors that businesses should consider when assessing their ESG performance:

- Climate Change

- Waste and Pollution

- Resource Scarcity and Depletion

- Water and Energy Efficiency

- Natural Resources Preservation

- Animal Welfare and Biodiversity

- Greenhouse Gas (GHG) Emissions

All these issues are significantly affected by business operations (no matter the size or type of business) and will greatly contribute to the overall health of the global, natural environment.

“S” is for Social

The “S” in ESG represents how a company manages stakeholder relationships (the workforce, the society in which it operates, and the respective political environment.) The Social factor includes all the societal aspects connected to the business, with particular emphasis on organizational policies and practices concerning human rights, business ethics, supply chain management, diversity and inclusion, and social impacts. Due to the complexities inherent to this last concern, the social pillar in ESG may be more difficult to define and quantify than the environmental, but it can just as directly impact the financial performance of a company.

A strategic and long-term focus on social performance provides companies the unique opportunity to continually redefine their role and purpose in society. Currently, global businesses need to rethink how they can collectively help address societal problems regarding poverty, inequality, and mental health. Businesses that effectively manage their social presence financially outperform their competitors and have acquired social permission to operate from the communities they depend on.

In 2015, at the United Nations Summit in New York, participating countries adopted the 2030 Agenda for Sustainable Development (1). This Agenda, also known as the UN Sustainable Development Goals (SDGs), is a broad policy agenda with 17 goals and 169 associated and integrated targets. The UN SDGs aim to unite the UN Member States in achieving inclusive, sustainable development with a people-centered approach allowing for no one to be left behind. The SDGs are a plan of action for people, the planet, and prosperity that have created a strong, universal focus on social issues. Along with caring for the planet, the SDG’s determination of ending poverty and hunger serves to ensure that all human beings can fulfill their potential in dignity and equality, in a safe and healthy environment. The goals also focus on the prosperity and peace of people, entreating nations to become inclusive societies that are free from fear and violence. As the world begins to concentrate more on ESG concerns, the UN SDGs have gained massive momentum and are increasingly being recognized as a foundation for responsible investment.

Some of the societal issues from the SDGs that directly affect businesses include:

- Working Conditions

- Equal Opportunities

- Human Rights

- Employee Diversity

- Child Labor and Slavery

- Community Relations & Human Rights Workplace Health & Safety

- Diversity & Inclusion

- Political Ties

- Philanthropy

A business that can label its performance in these areas as “excellent” is successfully navigating the social pillar of ESG.

“G” is for Governance

The “G” in ESG refers to the structure of rules, practices, and processes used to direct and manage a company. A company’s board of directors is the primary force influencing its corporate governance (the decision-making process regarding areas of environmental awareness, ethical behavior, corporate strategy, compensation, and risk management.)

Accountability, transparency, fairness, and diversity are the basic principles that responsible corporate governance employs. By following these principles, companies show positive growth direction and business integrity. Compelling corporate governance practices help companies build trust with the community, promoting financial viability for the future of the business and opportunities for investors. Poorly planned or executed governance practices can elicit distrust in a company’s operations and doubts about its prospects, impacting profitability and financial viability.

To realize the state of their performance on governance issues, businesses should analyze the following metrics:

- Business Ethics

- Executive Pay

- Board Diversity and Structure Bribery and Corruption

- Political Lobbying and Donations Tax Strategy

- Compliance

How a business operates within these categories will affect its overall standing in the realm of ethical governance.

What is ESG investing?

ESG Investing refers to strategic investing which prioritizes optimal environmental, social, and governance (ESG) factors or outcomes in which a company measurably contributes to the betterment of the world.

Commonly known as “socially responsible investing” or “impact investing,” ESG investing involves independent ratings that assess a company’s behavior and policies regarding environmental performance, social impact, and governance issues. ESG investing provides the opportunity for investors to influence positive change in society, correlating to the idea that the financial performance of organizations is increasingly affected by environmental, societal, and governance factors.

Current trends in ESG investing

Due to this increase in public awareness of the impact of ESG concerns, ESG investing has grown rapidly in recent years. In 2021, ESG funds accounted for 10% of worldwide fund assets. According to Definitive Lipper data (2), by the end of 2021 $649 billion funded ESG-related efforts worldwide, whereas in 2019 it was only $285 billion.

Both organizations and individuals are recognizing the interdependencies of social, environmental, and economic issues and the impact business has on them. The COVID-19 pandemic inevitably fueled this growth in the ESG investing market, due to the need to create more resiliency in businesses and to aid recovery after the triggered economic crises. More investors are interested in funding organizations and products that promote sustainability and are current with emerging regulations, such as climate change policies and supply chain due diligence. This growing demand has been met with an increased focus on ESG by businesses and higher returns on investment for ESG funds due to greater resilience than conventional markets.

Determining materiality

Which ESG issues matter?

Businesses are incredibly diverse in the way they operate, their sectors, and their impact. The relevance of ESG issues varies across sectors and organizations alike. To monitor, manage, and report their ESG performance, companies need to first understand what specific issues are important to their business operations, the “material issues.”

Material issues are relevant within different contexts, including legal, financial, regulatory, and record-keeping. For most businesses, financial materiality, or how the bottom line is affected, is the most apparent issue. However, materiality is also relevant in the non-financial context, such as sustainability, governance issues, and corporate social responsibility (CSR.) Non-financial material issues can also have a financial impact, lending relevance to the ESG investing industry. When companies invest in ESG issues, the resulting financial outperformance is a reinvestment in the company itself.

A materiality assessment is necessary to determine which issues are relevant to a company. Companies can begin their materiality assessment by analyzing certain circumstances, including their industry, sectors, and business operations. Another integral step in a materiality assessment is determining what issues are material to the company’s stakeholders and the societal role of that business via social engagement.

Assessing materiality also helps companies stay on top of regulatory and legal developments. Stock exchanges (such as the Hong Kong Stock Exchange or HKEX) have provided tools for firms to better manage their material issues. Once a company has identified its material issues, focusing on defined targets and goals, and allocating resources and time are the next steps to address these material issues. Companies can create a clear roadmap using quantitative key performance indicators (KPIs) and will then be able to drive action and accountability on non-financial targets that influence the society and the environment, such as decreasing the gender pay gap, promoting diversity, reducing emissions, and aligning with UN SDGs. These actions rapidly improve a company’s ESG performance.

Measuring and reporting ESG performance

The first step in measuring and reporting ESG performance for a company is conducting a materiality assessment, as mentioned in the previous section. By planning for what exactly will be measured, the process of reporting ESG target performance becomes easier. Through sustainability reporting, companies report their ESG performance, while communicating their sustainability goals. At present, there are several standards for sustainability reporting. The most universal and recognized of these are:

- Global Reporting Initiative (GRI) (3) : The GRI is a globally dominant reporting standard that focuses on corporate social responsibility and environmental, social, and governance issues. The GRI has also mandated the inclusion of a materiality analysis in all GRI-aligned reports.

- Sustainability Accounting Standards Board (SASB) (4): The SASB Standards were created for US companies to communicate their financially-material sustainability information to investors.

- Carbon Disclosure Project (CDP) (5): The CDP is a global disclosure system that focuses on environmental impacts (specifically, carbon footprint, forestry, and water.)

Depending on which issues are material to the company and which reporting standard is most appropriate to their business, companies can utilize these standards to publicly disclose their non-financial information and create opportunities for ESG investing. Several agencies and groups will use companies’ publicly disclosed nonfinancial information from their websites, sustainability reports, or other mediums to rate and compare them.

How can companies improve their ESG performance?

ESG Investing enables reductions in cost to businesses through innovative strategies and improved employee engagement, providing motivation for companies to consider investing and prioritizing environmental, social, and governance issues relevant to them. Essential steps that businesses can take to improve their ESG performance include:

- Recognizing that doing good externally and internally are not mutually exclusive.

- Conducting a materiality assessment to identify material topics and plan ESG targets.

- Integrating ESG targets into the existing business strategy.

- Understanding ESG performance and rating as compared to competitors.

- Aligning with global and regulatory frameworks to gain a competitive advantage.

- Educating employees about sustainability and ESG through training opportunities.

- Measuring carbon emissions, specifically Scope 1 (emissions from direct combustion) and Scope 2 (indirect emissions.) The GHG Protocol provides companies with guidelines on how to measure and monitor their Scope 1 and Scope 2 emissions.

- Conducting Life Cycle Assessments (LCA) on products and assessing indirect and direct impacts from the supply chain.

- Consulting with external ESG experts.

- Publicly disclosing ESG performance and targets to keep stakeholders, including investors, informed on progress concerning non-financial issues.

The future of ESG

Embedded Sustainability

At present, the world faces three significant challenges in terms of sustainability: declining resources, demand for radical transparency, and heightened expectations. Natural resources are dwindling faster than they can be reproduced. Customers, investors, and governments are placing new demands on businesses for accountability, with ever-increasing expectations for corporate social responsibility. This pressure has forced most businesses to adopt social responsibility initiatives for marketing and branding purposes. However, businesses are recognizing that embedding sustainability has more than a superficial purpose.

As more companies have incorporated environmental, health, and social values into their core business activities the market information is showing little to no trade-offs in price or quality for their products and services. Such organizations have made a fundamental shift across every dimension within their business systems, defying traditional approaches to CSR that historically added cost and provided no value. Embedding sustainability will meet both investor and stakeholder requirements by creating monetary, environmental, and social value for a business and is the future of ESG.

Notes

- Commission for Social Development (CSocD). “Transforming our world: the 2030 Agenda for Sustainable Development.” Social Development for Sustainable Development, United Nations, https://www.un.org/development/desa/dspd/ 2030agenda-sdgs.html

- Kerber, Ross and Simon Jessop. “Analysis: How 2021 became the year of ESG investing.” Reuters, Thomson Reuters, 23 December 2021, https://www.reuters.com/markets/us/how-2021-became-year-esg-investing-2021-12-23/.

- “GRI Standards English Language.” Global Reporting, Global Reporting Initiative, 2022, https://www.globalreporting.org/how-to-use-the-gri-standards/gri-standards-english-language/.

- “Standards Overview.” SASB Standards, Sustainability Accounting Standards Board, 2022, https://www.sasb.org/standards/.

- “What We Do.” CDP Disclosure Insight Action, CDP North America Inc., 2022, https://www.cdp.net/en/info/about-us/what-we-do.

Your Complete, Cloud-Based Safety Solution

An online, integrated platform to protect your team,

reduce risk, and stay compliant